Maintain compliance and control with the proven SaaS-based Payroll Tax Filing solution that offers flexible delivery and outsourcing options to meet your evolving needs.

Employment growth trends like the rise of remote work, expansion into new markets, and high-volume onboarding all impact payroll tax processing. The challenge is compounded by the ever-increasing complexity of state and local laws and the thousands of nuances that payroll tax filings must address.

Asure empowers businesses to keep pace with these changes while remaining compliant with a dizzying array of evolving legislation. Our Payroll Tax Management solution alleviates the burdens of PTM with comprehensive support and unprecedented visibility for scheduling, filing, and monitoring payroll tax returns.

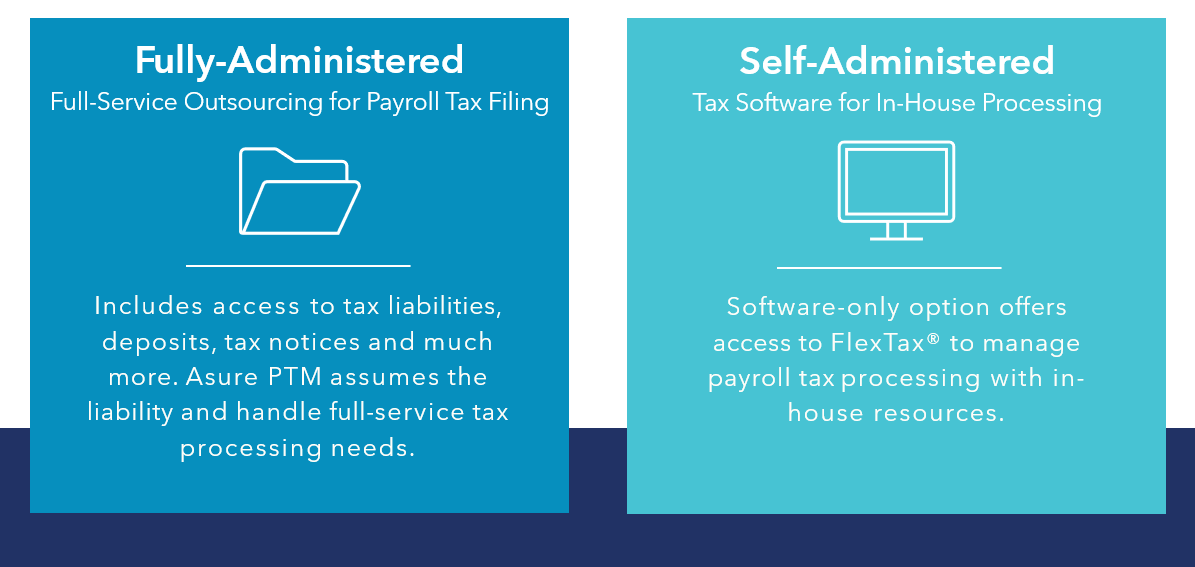

Whether you need a full-scale payroll tax filing outsourcing service or web-based tax software to manage in-house, we have options to meet your needs and budget, even as they change and grow. Since our service options use the same robust software, you can move between plans with ease.

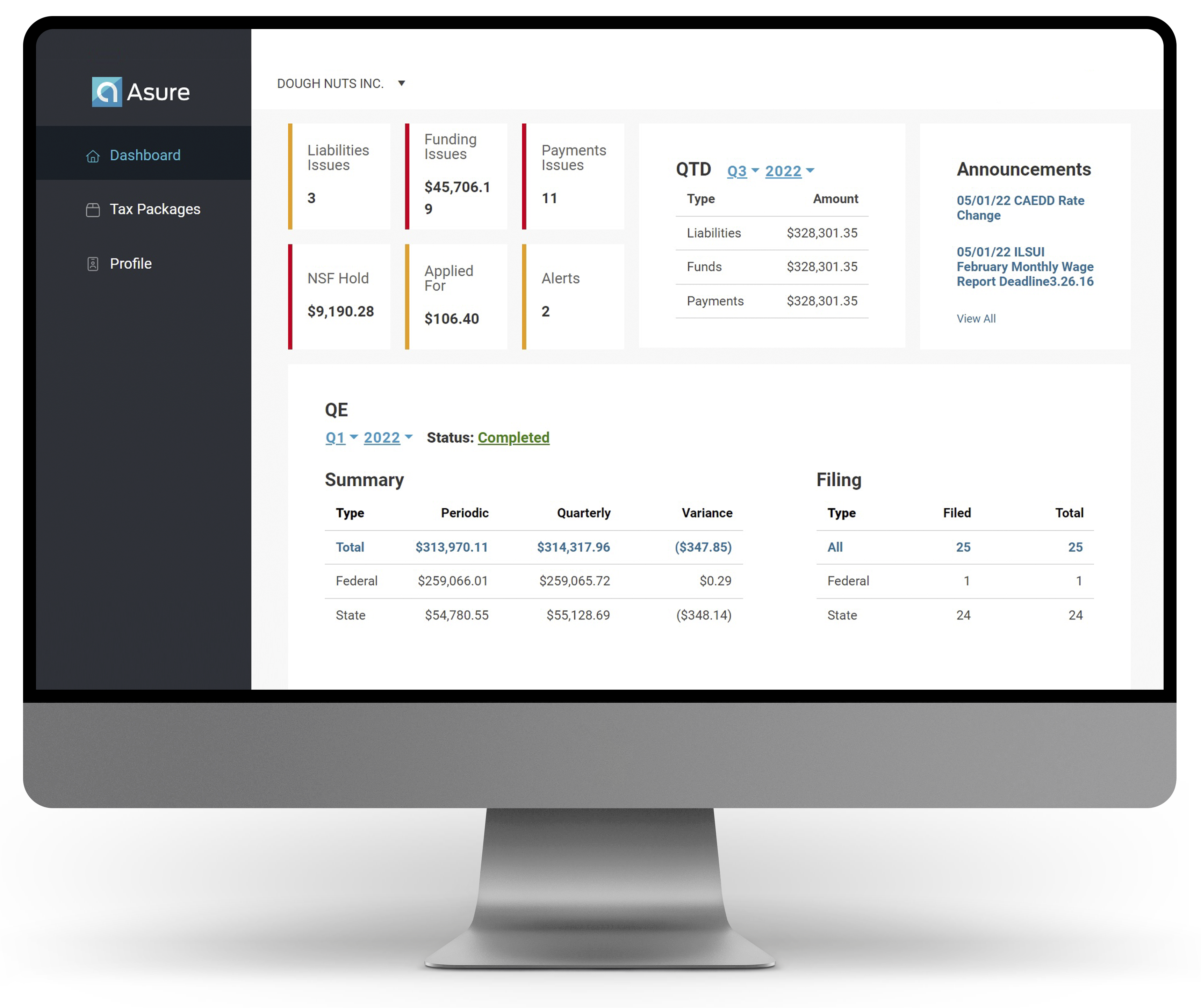

Gain unprecedented transparency into tax returns, schedule, agency status, tax funding, and payment status

Make more informed decisions and boost efficiency with the Asure Tax Portal, a convenient web portal that provides access to historical and current-year tax data, plus all related tax information including liabilities, deposit records, and copies of the actual tax returns. The secure, easy-to-navigate portal displays real-time status of all your tax filing reports for Federal, State, and local municipalities. This transparency is especially valuable to enterprise customers with large, geographically diverse workforces who must manage taxes across many tax jurisdictions.

Easily manage tax filing for high-volume hiring and remote employees in other states

Managing multistate payroll taxes can be overwhelming. With the rise of remote work and a focus on employee flexibility, many employers are facing a heightened need to process payroll taxes that cross state lines. This multi-state filing process adds to the complexity of payroll taxes, especially with changing state and local laws and an evolving workforce. Our system and our experts are equipped to handle the complexity.

-Pat Goepel, Asure Chairman & CEO

Copyright ©2025 Asure. All Rights Reserved.