If you are looking for ways to infuse your margins and help your clients grow their business, partner with Asure and provide solutions that streamline and automate manual processes and keep them compliant. Expand your portfolio with access to exclusive tools and resources that empower your customers to remain compliant, grow with confidence, and automate one of their most manual processes - tax filing. As an Asure partner, we're making it easier than ever for you to deliver innovative and integrated payroll and HR solutions and support your clients into the future. Deliver these high-value services:

ERTC Filing: With the Employee Retention Tax Credit (ERTC), your customers may be eligible to receive up to $26K per employee.

Essential HCM: The comprehensive Essential HCM solution delivers automated payroll, employee self-service, digital onboarding, and more.

Payroll Tax Management: Provide tools to help your clients stay compliant, automate & streamline payroll tax processing, and avoid risk.

Asure Tax Portal: Deliver premium visibility with our easy-to-use 24/7 online tax portal.

Help Your Clients Get the Funds They Deserve, Claim Up to $26K Per Employee

The Employee Retention Tax Credit is a generous yet complex and often misunderstood stimulus program available to small business owners who were impacted by the pandemic. ERTC can be claimed retroactively, and the window to file for credits is still open. Even small businesses that claimed a PPP loan can still be eligible for ERC. If your client is eligible, Asure can calculate ERC (employee retention credit) wages and file the amended returns with the IRS.

Streamlined Payroll and HR Admin Tasks with Software Built for SMBs

Connect new and existing clients with payroll solutions that can meet their needs now and scale with them as they grow. Automate and outsource the complex management of wages, direct deposit, tax codes, and all payroll and tax functions to experts who ensure you remain compliant. This quarter's promotional bundle includes the Payroll with EHR plan with payroll services, plus time-saving features like employee self-service, digital onboarding and more.

.png?width=1037&name=MicrosoftTeams-image%20(42).png)

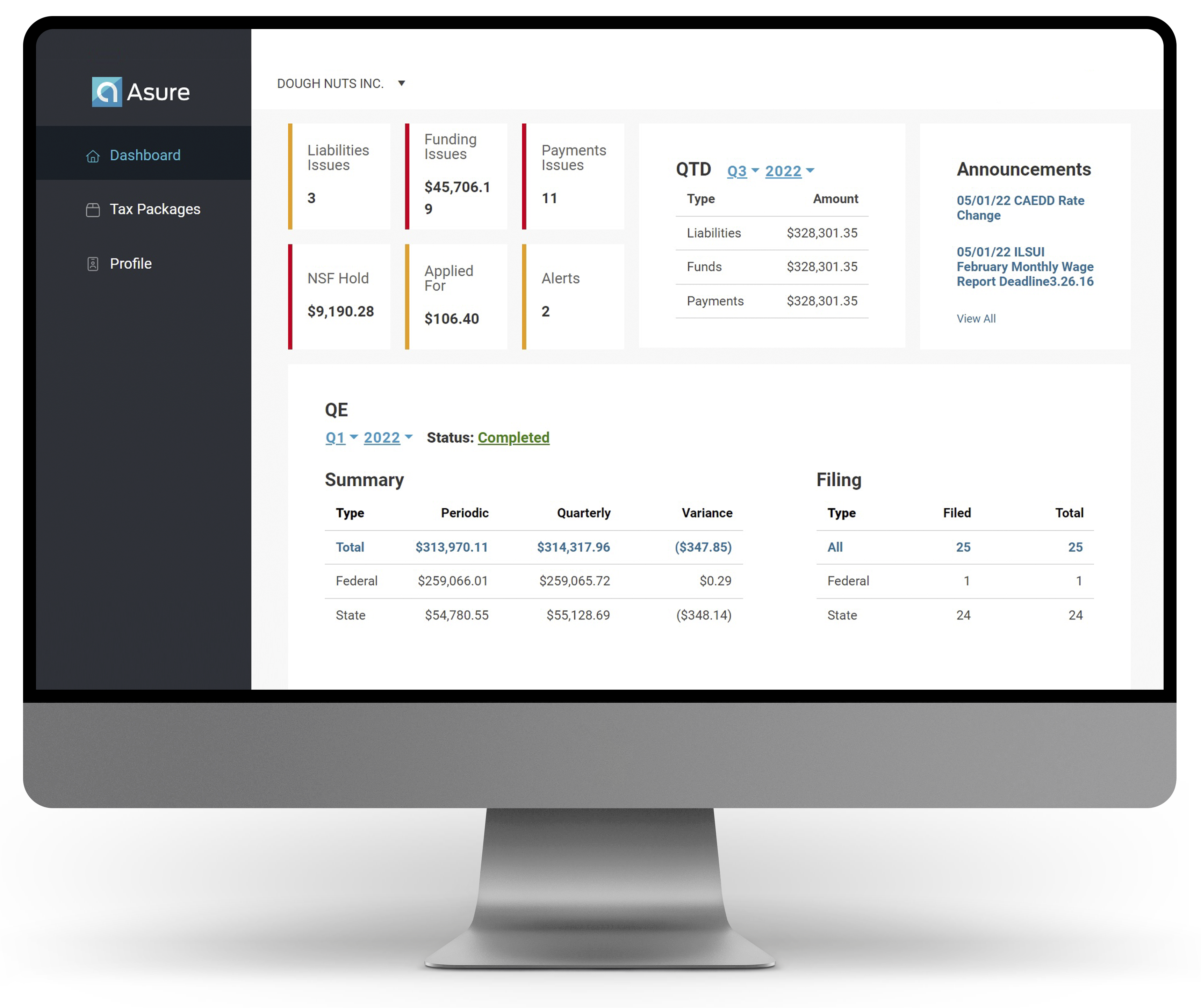

Gain unprecedented transparency into tax returns, schedule, agency status, tax funding, and payment status

Make more informed decisions and boost efficiency with the Asure Tax Portal, a convenient web portal that provides access to historical and current-year tax data, plus all related tax information, including liabilities, deposit records, and copies of the actual tax returns. The secure, easy-to-navigate portal displays real-time status of all your client's tax filing reports for Federal, State, and local municipalities. This transparency is especially valuable for resellers who have clients with large, geographically diverse workforces who must manage taxes across many tax jurisdictions.

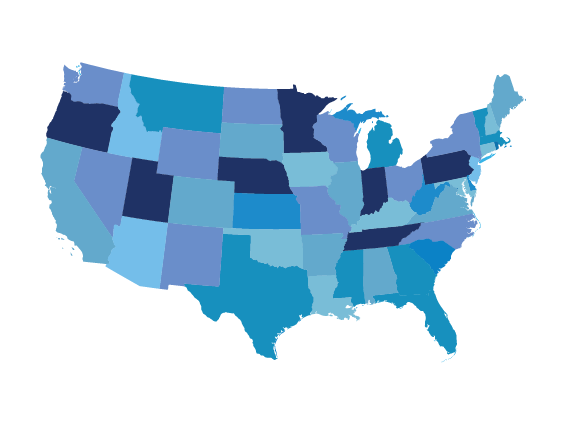

Easily manage tax filing for high-volume hiring and remote employees in other states

Managing multi-state payroll taxes can be overwhelming. With the rise of remote work and a focus on employee flexibility, many employers are facing a heightened need to process payroll taxes that cross state lines. This multi-state filing process adds to the complexity of payroll taxes, especially with changing state and local laws and an evolving workforce. Our system and our experts are equipped to handle the complexity.

-Pat Goepel, Asure Chairman & CEO

Copyright ©2025 Asure. All Rights Reserved.