Asure Client - Manufacturer, Skokie, IL

"We're getting a $689k tax credit. That's exactly the help we needed to climb out of the downturn."

Asure Client - Restaurant, Galveston, TX

"By filing amended returns for 2020, Asure is helping us get back $555k.

That's a lifesaver for us."

What is ERTC?

The Employee Retention Tax Credit (ERC or ERTC) is a payroll tax refund provided by the U.S. Treasury Department, introduced as part of the CARES Act and was designed for businesses that retained their employees during the pandemic. If your business was impacted by the pandemic, you may be eligible to claim ERTC and get a payroll tax refund of up to $26k per employee to invest in your business.

ERTC Quick Facts:

- Small businesses can claim up to $26K per employee.

- The ERTC is one of the single largest small business stimulus in U.S. history.

- Even businesses that claimed a PPP loan can still be eligible for ERC.

- This is not a loan and does not need to be repaid.

- ERTC can be claimed retroactively, and the window to file for credits is still open.

How Does it Work?

- Check your eligibility. Our easy ERC application collects basic information to help determine qualification.

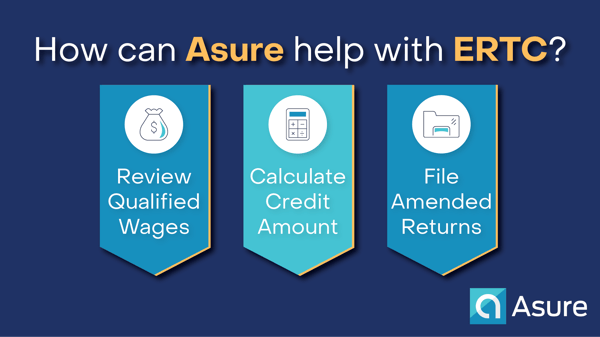

- Our ERC experts will review your qualified wages

- Our ERC experts will calculate your credit amount

- Our ERC experts will gather documentation and file the amended returns with IRS

- You receive your funds

ERTC FAQs

Qualified wages are compensation provided to employees during an eligible period. An eligible period is either:

a) the time during which the trade or business is fully or partially suspended by a governmental order, or

b) for 2020, any calendar quarter during which gross receipts are 50% less than the amount received during the same quarter of 2019; for 2021, any calendar quarter during which gross receipts are 20% less than the same quarter of 2019.

For additional information, visit the IRS website: https://www.irs.gov/coronavirus/employee-retention-credit

SMBs can claim up to $26K Per Employee

2020 Credits

The 2020 CARES Act established an employee retention credit of 50% of $10,000/employee in qualified wages for eligible businesses or $5,000 tax credit per employee. Originally, businesses had a choice between PPP funds or ERTC credits, but not both. Then, on Dec. 27, 2020, the Consolidated Appropriations Act (CAA) modified the CARES Act so that businesses who received PPP loans can now retroactively also participate in ERTC so long as they don’t double-dip and apply for ERTC with payrolls paid with PPP funds.

2021 Credits

The Consolidated Appropriations Act (CAA) passed on December 27, 2020, and extended the ERTC to Q1 and Q2 of 2021 with richer benefits and new eligibility requirements. Then, the American Rescue Plan Act (ARPA) was signed into law on March 11, 2021, and extended ERTC through Q3 and Q4 of 2021. Q4 was later eliminated by The Infrastructure Investment and Jobs Act, signed into law on Nov. 15, 2021.

The 2021 credits total 70% of wages up to $10,000 per employee per quarter. The result is a credit up to $7,000 per employee for up to three quarters in 2021 totaling $21,000.

For additional information, visit the IRS website: https://www.irs.gov/coronavirus/employee-retention-credit

1. Suspension of operations in 2020 due to a government order

You operated a trade or business during the calendar year 2020 and experienced a full or partial suspension of operations during any calendar quarter on

account of a governmental order limiting commerce, travel or group meetings due to COVID-19.

2. Gross receipts declined more than 50% in 2020

Your business suffered a significant decline in gross receipts by more than 50% when compared to the same quarter in the prior year.

3. Suspension of operations in 2021 due to government order

You had a full or partial suspension of operations business during a calendar due to governmental order limiting commerce, travel or group meetings due to COVID-19.

4. Gross receipts declined in 2021 compared to 2019.

Your business suffered a decline in gross receipts in the first, second or third calendar quarter in 2021, where the gross receipts of that calendar quarter are less than 80% of the gross receipts in the same calendar quarter in 2019.

5. Your business was affected by a supplier being unable to make deliveries.

For example, a raw materials supplier was required to shut down due to government orders. As a result of the suppliers’ shutdown, a manufacturer was not able to perform its operations because it was not able to source an alternative supplier.

6. Your business could only operate on a limited capacity due to governmental order.

An example would be a restaurant that was ordered to close on-site dining, which was a substantial part of its business. However, it was allowed to continue carry-out service.

7. Your business had to reduce its operating hours due to governmental order.

The local health department required all food processing businesses to deep clean their workplaces once every 24 hours to reduce COVID-19 exposure. To comply, the employer had to reduce its daily operating hours to conduct the cleaning.

For additional information, visit the IRS website: https://www.irs.gov/coronavirus/employee-retention-credit

If you are a city, state, or federal government entity, you are not eligible under the CARES Act or Employee Retention Credit. If you're self-employed, generally, you're not considered eligible, but specific exceptions might apply based on your unique circumstances.

Tribal governments could potentially qualify. The eligibility criteria will become clearer as you go through the application procedure, guiding you in understanding what benefits you can claim.

Still not sure if your business qualifies? Start getting your papers together. The best way to know if you qualify is to apply.

For additional information, visit the IRS website: https://www.irs.gov/coronavirus/employee-retention-credit

The initial review to assess if you qualify and estimate your credit won't cost you a dime. Should you decide to proceed with an ERC application through us, our service charge will be a percentage of the credit you're slated to receive.

For additional information, visit the IRS website: https://www.irs.gov/coronavirus/employee-retention-credit

Client ERTC Tax Refund Successes

How Much Could You Get Back?

Find Out Today

Don't miss out on thousands in potential refunds. Unlock the power of the employee retention tax credit to maximize savings and strengthen your business. We've empowered our small business customers to claim more than $500 million in ERTC (and counting). Take the first step to learn how much your business may qualify for by checking your business's eligibility today.