Stay compliant, minimize risk, and fuel growth with the proven standalone, SaaS-based payroll tax filing solution.

Navigating the labyrinth of payroll tax can be overwhelming. Missed deadlines, form errors, and unexpected penalties can quickly become a business's nightmare. And, with the rise of remote work, and expansion into new markets, the intricacies of payroll tax processing have only deepened. Factor in the ever-evolving state and local laws, and the myriad nuances tax filings must address, and it's clear why so many businesses find themselves in a maze of complications.

Asure solves these challenges and empowers businesses to keep pace with these changes while remaining compliant with a dizzying array of evolving legislation. Our Payroll Tax Management solution alleviates the burdens of payroll tax management with comprehensive support and unprecedented visibility with our online tax portal for scheduling, filing, and monitoring payroll tax returns. We help you take back control and deliver peace of mind knowing we stay on top of 11,000+ taxing agencies throughout the U.S., so you don't have to.

Leverage one of the most robust Payroll Tax Management engines on the market, no matter which payroll system you use. Our standalone PTM offers flexible delivery options for in-house use or a fully outsourced solution. Delivered via a SaaS model with premium SOC 1 compliant security controls, Asure’s FlexTax payroll software features an intuitive interface to enter, view, and monitor all aspects of the payroll tax filing process.

24/7 Online Tax Portal Delivers

24/7 Online Tax Portal DeliversGain unprecedented transparency into tax returns, schedule, agency status, tax funding, and payment status

Make more informed decisions and boost efficiency with the Asure Tax Portal, a convenient web portal that provides access to historical and current-year tax data, plus all related tax information, including liabilities, deposit records, and copies of the actual tax returns. The secure, easy-to-navigate portal displays real-time status of all your tax filing reports for Federal, State, and local municipalities. This transparency is especially valuable to enterprise customers with large, geographically diverse workforces who must manage taxes across many tax jurisdictions.

Experience the Benefits:

Detailed Information at Your Fingertips: Each tile within the portal provides drill-down information at the EIN and jurisdiction level, giving you a comprehensive understanding of your tax landscape.

Easy Data Retrieval: Access all your information effortlessly through our portal and generate reports in Excel or PDF format, ensuring convenient data management and analysis.

Actionable Insights: Our dashboard offers visibility on variances and provides drill-down capabilities to pinpoint where actions are needed, simplifying your quarter-end processes.

Mobile Functionality: Stay connected and in control with our industry-leading mobile functionality. Access the portal anytime, anywhere, and enjoy the same seamless experience on your mobile devices.

Streamlined Navigation: Easily navigate through your EIN and jurisdiction information, simplifying your workflow and saving you valuable time.

Comprehensive Reporting: Generate detailed reports in Excel or PDF format for easy sharing and collaboration.

Action Cards: Stay on top of important tasks with our Action Cards feature, highlighting items that require your attention and ensuring nothing slips through the cracks.

Quick Access to Packages: Retrieve QE (Quarter End) and Return packages with ease, making your tax processes more efficient.

Convenient Profile Management: Access and update your profile, contact, banking, and agency information conveniently within the portal.

Timely Announcements: Stay informed with important announcements, including preparation reminders for Quarter End and other relevant updates.

Multi-State Filing Support

Multi-State Filing SupportEasily manage tax filing for high-volume hiring and remote employees in other states

In the modern business landscape, where remote work and multi-state employment are becoming the norm, ensuring compliance with payroll tax regulations has never been more crucial. The complexities of managing payroll taxes that span multiple states can be overwhelming for even the most seasoned HR and finance professionals.

The Significance of the "Nexus" Concept

In this dynamic scenario, the concept of "nexus" adds an extra layer of complexity. It means that you might be required to withhold taxes for an employee's home state, regardless of whether they physically work there or not. The risk of non-compliance is real, accompanied by substantial penalties. Asure Payroll Tax Management (APTM) automates tax withholding and filing, helping you ace compliance across all tax jurisdictions and prevent penalties.

Seamless Compliance Across Jurisdictions

Maintain compliance across all tax jurisdictions effortlessly, keeping up with shifting laws and regulations without breaking a sweat. Minimize the risk of penalties by relying on automated, error-free tax filing that adheres to all applicable laws and avoid penalties that eat into your bottom line.

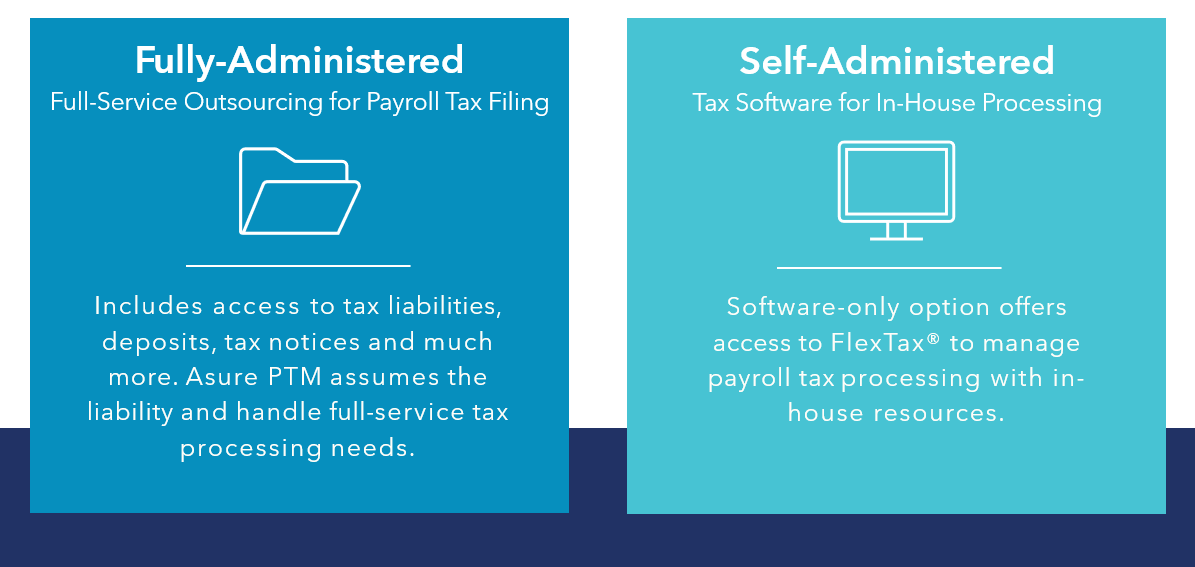

Whether you need a full-scale payroll tax filing outsourcing service or web-based tax software to manage in-house, we have options to meet your needs and budget, even as they change and grow. Since our service options use the same robust software, you can move between plans with ease. Our software helps you stay compliant with the flexibility of a stand-alone product that allows you to streamline your payroll tax processing, avoid risk, and grow your business.

-Pat Goepel, Asure Chairman & CEO

Copyright ©2025 Asure. All Rights Reserved.