Payroll taking up too much time?

As a CPA, you have enough on your plate without the added stress of managing payroll for your clients. With Asure, you can refer your payroll clients to us and we’ll handle all the administrative tasks. Focus on what you do best while we ensure your clients’ payroll is managed efficiently and accurately.

Payroll compliance overwhelming?

Managing payroll compliance with changing regulations like MTA, NACHA, and others can be overwhelming. The regulatory uncertainty and potential penalties for unlicensed activity have been all over the map, anywhere from $20,000 to $875,000.

Protect your clients and yourself from stress and penalties, while we ensure efficient and compliant payroll management, allowing you to focus on your core expertise.

We understand your business

At Asure, we know the ins and outs of payroll and HR administration. Our team is dedicated to making your management of client payroll and HR simple, efficient, and compliant helping you save time and serve your clients better.

Meet Asure: Your Trusted Payroll Partner

At Asure, we understand the challenges you face in managing payroll for your clients. We specialize in providing comprehensive payroll solutions that allow you to offload this burden, freeing you to focus on your primary services. Our expertise and dedication make us the ideal partner to help you streamline your operations and enhance your service offerings.

Meet Asure: Your Trusted Payroll Partner

At Asure, we understand the challenges of payroll management and compliance. We offer comprehensive payroll solutions to ease your workload, allowing you to focus on your core strengths. Partner with us to streamline operations, expand services, and strengthen client relationships, while ensuring compliance with regulations like MTMA, KYC, NACHA, and the Bank Secrecy Act.

Learn more about the different ways we can support your clients and your business.

Benefits of Partnering with Asure

By referring your clients to Asure, they gain access to advanced technology, expert guidance, and a customer-centric service model. Additionally, we help you stay compliant with regulations like MTMA, KYC, NACHA, and the Bank Secrecy Act, avoiding the stress, extra costs and possible penalties.

![]() Payroll & HR Solutions: Give your clients access to the best payroll and HR technology with Asure. Streamline payroll and HR processing and administration.

Payroll & HR Solutions: Give your clients access to the best payroll and HR technology with Asure. Streamline payroll and HR processing and administration.

![]() Industry Expertise: We offer unmatched industry expertise and tailored solutions to meet your clients' unique needs, providing top-notch payroll and HR advice and support.

Industry Expertise: We offer unmatched industry expertise and tailored solutions to meet your clients' unique needs, providing top-notch payroll and HR advice and support.

The Challenge: Seismic Shift Impacting Payroll Providers

The world of payroll services is evolving rapidly, driven by changing regulations and advances in technology. CPAs and accounting firms providing payroll services face a variety of challenges in striving to stay compliant and maintain the highest level of service.

The top 5 challenges crushing most CPAs:

- Money Transmission Modernization Act (MTMA)

- Bank Secrecy Act (BSA), AML & KYC

- NACHA

- Technology & Cybersecurity

- GDPR-Style Data Privacy

The Solution: Asure

At Asure, we help CPAs and accounting firms protect profits, mitigate risks by staying compliant, and optimize revenue through referral partnerships with revenue share, white-label payroll services with wholesale pricing, or an exit strategy that purchases your book of business for a seamless client transition.

Asure has dedicated representatives for each of your clients. It's very helpful because they are familiar with your account, and you know exactly who you're talking to. They are also responsive and good about sending reminders. Reports are easily accessible and can be accessed at any time. Onboarding new clients is also easy, and their onboarding specialists do a good job with follow-up."

- G2 Customer Testimonial

What's Changed in Payroll Compliance?

What does it mean if you process payroll?

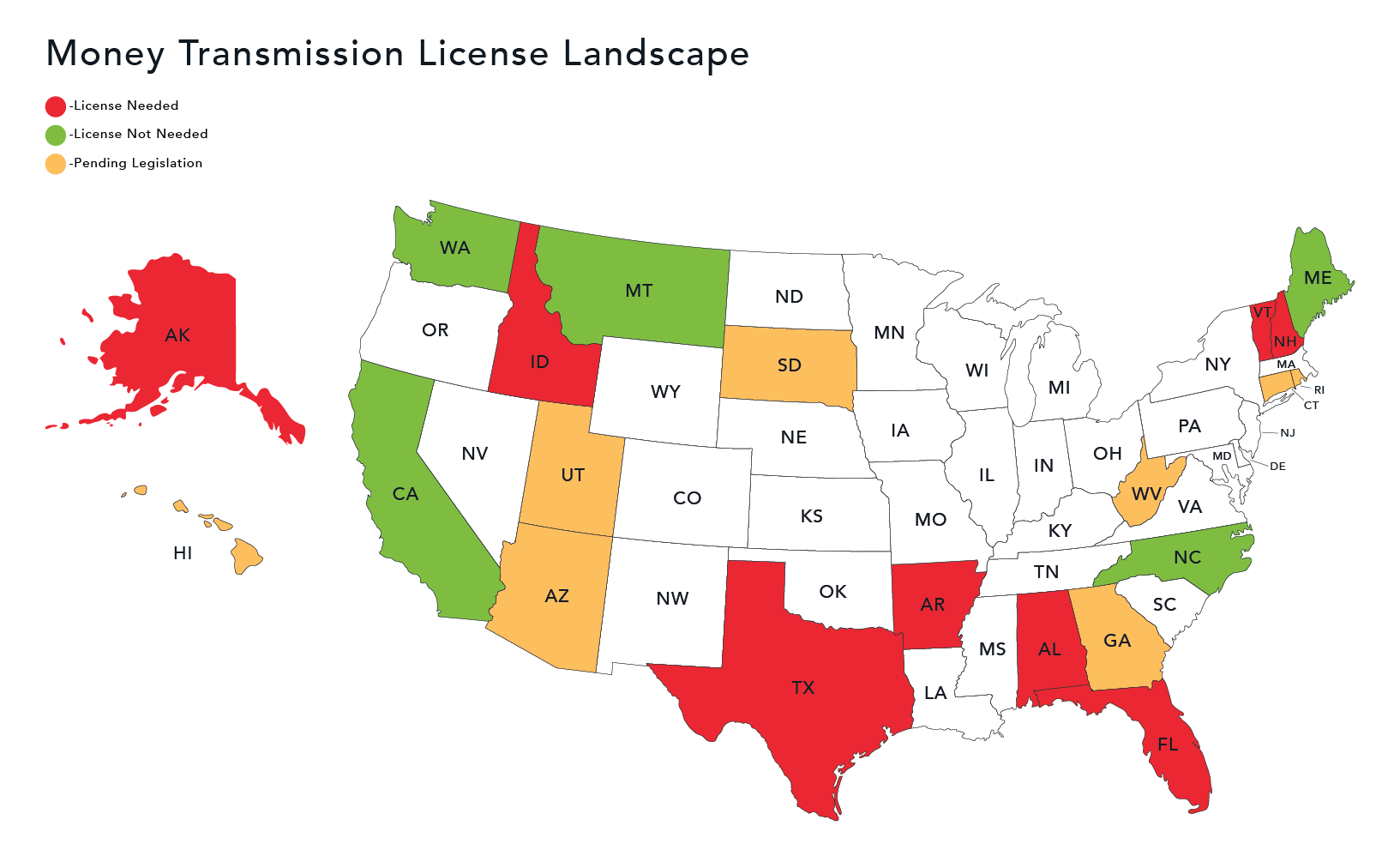

The Money Transmission Modernization Act (MTMA), also known as the Money Transmitter Model Law, is unifying state-specific money transmitter laws into a national standard with the goal to create consistent regulations across states. Currently, 10 states have enacted MTMA, with 20 more considering it.

The new legislation will create challenges for businesses during the transition period, including:

>> Red states have interpreted their money transmission laws to include payroll processing. This is evident from enforcement actions by their banking or financial regulation departments against payroll processors for unlicensed activities.

>> Green states have clear exceptions or exemptions in their money transmission acts explicitly stating that payroll processing does not fall under the definition of money transmission.

>> Yellow states have recently enacted a new money transmission modernization act, which now includes payroll processing services within the scope of money transmission.

>> White states are either completely unclear or have not enacted any specific legislation regarding this matter, resulting in a considerable amount of ambiguity throughout the marketplace and across the country.

Get our free ebook on how you can level up your B2B SaaS content marketing

Get our free ebook on how you can level up your B2B SaaS content marketing

Protect You & Your Clients' Businesses from Penalties for Unlicensed Activity

Administrative penalties for unlicensed activity have been all over the map, anywhere from $20,000 to $875,000.

Compliance with MTA for money transmitters comes with hefty costs like ongoing expenses for reporting, audits, and legal fees. Discover how we can help you avoid the stress and penalties for unlicensed activities.

Bank Secrecy Act (AML and KYC)

The Bank Secrecy Act (BSA) targets money laundering by requiring financial institutions in the U.S. to keep records and report on certain transactions and suspicious activities.

Although Certified Public Accountants (CPAs) are generally not classified as financial institutions and hence aren't directly bound by the BSA, you may encounter difficulties related to this law, particularly when offering advisory services such as payroll.

Impacts:

- Compliance: Ensure updated procedures to meet BSA's reporting and record-keeping.

- Risk Assessment: Develop and maintain systems to manage money laundering risks per BSA guidelines. CPAs advising these institutions should assist in setting up and maintaining BSA-compliant risk assessment programs.

- Legal Liability: Potential liability for advising on activities violating BSA.

National Automated Clearing House Association (NACHA)

NACHA manages the ACH Network for electronic money and data transfers in the U.S. As of June 30, 2022, it requires organizations to use tokenization when storing bank account information.

Certified Public Accountants (CPAs) face challenges with NACHA's complex, frequently updated rules. These include transaction limits, strict timing, and the need for secure systems. Firms must resolve discrepancies quickly and maintain records for audits, which is costly but necessary for compliance and avoiding penalties.

Technology, Cybersecurity & GDPR-Style Data Privacy

Protecting sensitive data, especially Personally Identifiable Information (PII) in payroll services, is crucial as digital threats grow. CPAs managing financial data are prime targets for cybercriminals, risking financial penalties and loss of customer trust.

The General Data Protection Regulation (GDPR) provides a strict framework for handling personal data. Payroll service providers must comply to protect employee data, secure data transfers, and maintain transparency and individual rights.

Laws like GDPR and the California Consumer Privacy Act (CCPA) require businesses to keep client information accurate and current to ensure data consistency.

Explore Your Options with a Free Consultation.

Partner with Asure and watch your clients thrive with our HCM solutions, expert insights, and outstanding service. We handle the complexities of payroll compliance, including navigating the regulatory uncertainty of MTA, NACHA, and other regulations. Connect with us to learn more.