Affordable Small Business 401(k) Plans

Unlock Tax Credits, Get 1-Year of Free Payroll and Attract Top Talent.

Offering a 401(k) plan today goes beyond just a retirement saving option; it's a clear sign of your commitment to your employees' future and your company's values. With a notable lack of retirement savings among American families and a small percentage of small businesses providing such plans, this is your chance to truly stand out and make a positive impact on your team.

We offer a cost-effective, comprehensive 401(k) plan that:

- Comes with tax credits for qualifying businesses, reducing setup costs for new plans.

- Features flexible, customizable plans to fit your company's specific needs and budget.

- Helps attract and retain top talent.

- Offers a user-friendly platform for employees, simplifying the start-up process.

- Streamlines administration by integrating seamlessly with Asure payroll.

The Asure 401(k) plan represents more than just an employee benefit; it's a strategic investment in your business's growth and success. Take the first step towards a more secure future for both your employees and your business.

Financial Compliance Powered by the Expertise of JP Morgan

Navigating today's complex financial regulations and security concerns is a major challenge. Compliance with regulations like Money Transmitter Laws (MTMA), Anti-money Laundering (AML) and Know Your Customer (KYC) are time-consuming and prone to error while the risk of cyberattacks requires strong security measures.

Asure's Treasury Compliance Services offers a comprehensive solution that simplifies financial compliance while prioritizing data privacy and security. Powered by JP Morgan, get unparalleled protection through bank account tokenization and AWS Central Monitoring. This means your sensitive financial data remains secure at all times, giving you peace of mind.

Streamline compliance processes, everything from MTMA, ACH agreements to AML protocols and KYC procedures. We take care of state licensing requirements for money transmitters, eliminating the headache of navigating complex legal landscapes. Our experts stay up to date with the latest regulatory changes, ensuring your business remains fully compliant.

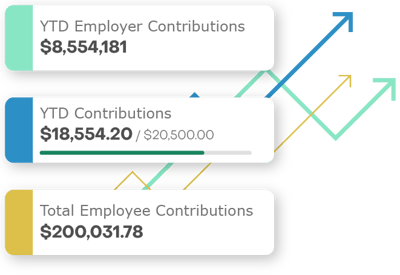

One tool for all your metrics

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt.

Tax Credits for Small Businesses

Providing a 401(k) for your team is more affordable than you may think. Thanks to the passing of Secure Act 2.0, eligible small businesses can claim up to 100% of the start-up administration expenses. SECURE Act 2.0 is a legislation designed to enhance retirement security amid the changing landscape of retirement savings in the United States. One of the key components of the act is to encourage employer participation in retirement planning.

This legislation incentivizes small businesses to offer retirement plans to their employees by providing tax benefits and simplifying administrative requirements. By doing so, it aims to expand retirement savings opportunities and ensure more workers have access to employer-sponsored retirement plans.

SECURE Act 2.0 offers businesses benefits, including:

- Increased Tax Credits: Businesses, particularly those with automatic enrollment features, receive substantial tax savings immediately.

- Improved Accessibility: The act makes retirement planning more accessible and beneficial for employees, reflecting a nationwide commitment to their financial well-being.

ADVANTAGES OF ASURE 401(K)

Here’s all the good stuff

Employee Attraction & Retention

Stand out in the competitive job market. A robust 401(k) plan can be the competitive edge that draws top talent to your organization and fosters long-term commitment.

Expert Guidance, Support, and 401(k) Compliance

Asure offers ongoing support to ensure your 401(k) plan remains compliant. We'll handle all legal and regulatory details, ensuring you stay compliant.

Tax Advantages for Both Employers & Employees

Both employers and employees can enjoy significant tax benefits, making the 401(k) not just a savings tool but also a strategic financial decision.

Seamless Integration with Payroll

Our 401(k) solutions integrate effortlessly with your existing payroll. Administrative aspects, like enrollment, are streamlined and automated.

Elevate Your Benefits to a Better, More Robust Option

Many states now mandate retirement plans for workers. Asure offers a superior 401(k) plan that exceeds these basic requirements by integrating seamlessly with our payroll system and providing greater flexibility and benefits for your employees. Our plan is an ideal upgrade from state-mandated programs, ensuring compliance and ease. If you're in a state requiring such plans and haven't set one up yet, let Asure's expertise guide you through a hassle-free setup.

Have you benchmarked your current retirement offering against what is available in the market? Let us compare your current offer to Asure's 401(k) solution. Benchmark your current plan with a free assessment today.

_Map-01-min_Updated2.png)

How much can you save?

Eligible businesses may receive up to 100% of their startup costs. See what your potential savings can be.

%20Tax%20Credit%20Calculator%20Screenshot-min.png)

Harnessing the Power of 401(k) Plans: Attracting Top Talent to Small Businesses

94% of employers that offer 401(k) plans said retirement benefits help drive recruitment.

Get our free eBook on Why Small Businesses Should Offer a 401(k) NOW

Get our free eBook and dig into an action plan for businesses who want to overcome employee recruitment challenges.

What our customers say

“We needed a way to show our senior leadership team that marketing was producing results, and that’s hard when your metrics are scattered. This dashboard saved the day.”

“We needed a way to show our senior leadership team that marketing was producing results, and that’s hard when your metrics are scattered. This dashboard saved the day.”

“We needed a way to show our senior leadership team that marketing was producing results, and that’s hard when your metrics are scattered. This dashboard saved the day.”

Need clarification?

What is Secure Act 2.0?

SECURE Act 2.0 is a legislation designed to enhance retirement security amid the changing landscape of retirement savings in the United States. One of the key components of the act is to encourage employer participation in retirement planning.

This legislation incentivizes small businesses to offer retirement plans to their employees by providing tax benefits and simplifying administrative requirements. By doing so, it aims to expand retirement savings opportunities and ensure more workers have access to employer-sponsored retirement plans.

How can I earn tax credits?

The SECURE Act 2.0 aims to incentivize and facilitate small business employers’ participation in retirement planning for their employees. There are a variety of ways to take advantage of these tax credits while offering a competitive benefit and supporting your employees’ financial future.

1. Establish a Retirement Savings Program. Small businesses can claim up to 100% of the expenses associated with start-up and administrative costs for the first three years. The provisions call for tax credits up to the greater of $500 or $250 per eligible employee.

2. Offer an Employer Match. When you match employee contributions to their plan, their portfolio grows and so do your tax credits. Claim up to $1,000 per employee for your contributions made to their plans.

3. Collect Contributions Through Automatic Enrollment. New plans will be required to automatically enroll employees at a rate of at least 3% starting in 2025. Choosing a 401k plan that’s integrated with your payroll platform can streamline this process.

How much can I save with tax credits?

The SECURE Act 2.0 amplifies the tax credits available to eligible small businesses, making the initiation of 401(k) plans more financially attractive. Under this new legislation, the tax credit for startup costs has been significantly increased, enabling small businesses to recoup a larger portion of the costs associated with setting up new retirement plans.

The SECURE Act 2.0 makes it more affordable to invest in the long-term financial stability of your business and your employees.

• Tax Credit Amount - The tax credit now covers up to $5,000 in annual startup costs incurred during the first three years of the plan.

• Eligibility - Small businesses with up to 100 employees who earn at least $5,000 are eligible for this credit. The credit is particularly aimed at businesses that have not had a retirement plan.

• Ease of Claiming - Claiming the credit has been simplified to encourage more small businesses to take advantage of this incentive. Simply file Form 8881 with the IRS.

Tax Advantages for Contributions

For employer contributions, the SECURE 2.0 Act takes the tax advantages a step further. Businesses with 50 or fewer employees can claim a credit for the employer contribution for the first five tax years starting when the plan is initiated, up to $1,000 per employee.

Your business can claim 100% of the employer contribution in the first and second tax years. Then, claim 75% in the third year, 50% in the fourth year, and 25% in the fifth year. For employers with 51 to 100 employees, the credit is slightly reduced.

Secure Your Team's Future, Today.

Start your business' 401(k) in a few easy steps.

_v4-min.png?width=650&height=581&name=LP_New%20401(k)_v4-min.png)

%20eBook%20Cover%20Image_v1-min.png)